This question is a part of BIF's Special Webinar series which was created to help students affected by the July 2020 CFP® Exam postponement to September 2020.

Susanna purchased 500 shares of BIF, a blue-chip stock, which pays a $2.00 dividend currently. Dividends on the BIF shares are expected to grow 4% annually for the next three years. After three years, BIF dividends are projected to grow at 2%. Susanna has a required rate of return of 7%.

Currently, BIF is selling at $55.

Calculate the intrinsic value of BIF stock and identify whether the market price is overvalued or undervalued.

- $77.99, overvalued

- $69.33, undervalued

- $43.13, overvalued

- $41.30, undervalued

Scroll for answer...

Correct answer: C. The intrinsic value of BIF stock is $43.13. The $55 market price for BIF is overvalued.

Instructor insight:

STEP 1: Calculate the end-of-year dividend for three-years at the 1st dividend growth rate.

| Year 1 | 2.00 x 1.04 | 2.08 |

| Year 2 | 2.08 x 1.04 | 2.1632 |

| Year 3 | 2.1632 x 1.04 | 2.2497 |

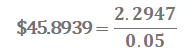

STEP 2: Calculate the stock valuation at Year 3 based on the new, constant dividend rate.

STEP 3: Solve for the Net Present Value (NPV).

|

Required Rate

|

7

|

I/YR

|

| Zero Entry | 0 | CF0 |

| D1 | 2.08 | CF1 |

| D2 | 2.1632 | CF2 |

| D2 + V | 48.1436 | CF3 |

| SHIFT, NPV | 43.13 |

CFP® Exam insight:

Multi-Stage Dividend Discount Model questions are often asked in a similar way. Here's the typical fact pattern:

A client owns a stock paying a certain dividend rate, which changes to another (constant) dividend rate in the future. A time frame and the client’s required rate of return will be provided. From there, you will be asked to calculate the valuation of the stock based on the dividend payments and, possibly, use a valuation result to determine whether a stock is overvalued or undervalued in the market.

As the name of the calculation states, there are many steps to conduct as you work toward a solution. Know that breaking the problem into three, smaller problems, makes the calculation more manageable and easier to understand.

.png?width=440&name=bryant_logo_lockup_edc_color%20(002).png)