This question is a part of BIF's Special Webinar series which was created to help students affected by the July 2020 CFP® Exam postponement to September 2020.

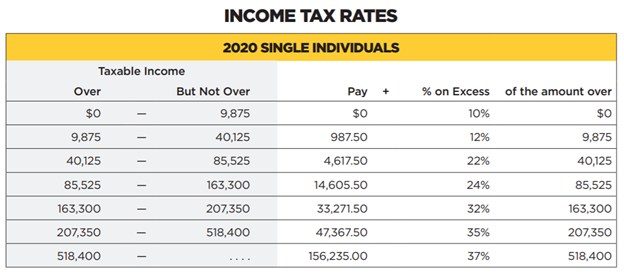

Use the 2020 CFP® Board provided Tax Tables to calculate the amount of tax payable for a single taxpayer with taxable income of $250,000. Next, use your solution to identify the taxpayer’s marginal tax rate and average tax rate.

Scroll for answer...

Correct answer: The tax payable $62,295. The marginal tax rate is 35%. The average tax rate is 24.92%.

Instructor insight:

At $250,000, the taxable income falls within the $207,350 - $518,400 range.

The 2020 Single Individual table below shows that $47,367.50 of tax is due on the first $207,350 of income:

Next, we calculate the amount of excess income on top of the first $207,350:

$250,000 - $207,350 = $42,650 of excess income.

The 2020 Single Individual table shows that this excess income of $42,650 is taxed at 35%:

$42,650 x 0.35 = $14,927.50

Finally, we add the two up to get the total:

$47,367.50 + $14,927.50 = tax payable of $62,295.

The taxpayer’s marginal tax rate is 35%. This is found by identifying the taxable income range on the table where the last dollar of taxable income falls.

The taxpayer’s average tax rate can be found by dividing the tax payable by taxable income:

$62,295 ÷ $250,000 = 0.2492, or 24.92%

CFP® Exam insight:

Several important tax tables and limits are available to candidates during the CFP® Exam. Get to know these PDFs in the weeks and months before your Exam date. You should know them like you know the back of your hand!

.png?width=440&name=bryant_logo_lockup_edc_color%20(002).png)