This question is a part of BIF's Special Webinar series which was created to help students affected by the July 2020 CFP® Exam postponement to September 2020.

Gloria and Art, aged 52 and 60 respectively, file MFJ and have a MAGI of $203,000 in 2020. The couple would like to contribute to a Roth IRA this year. What is the maximum contribution Gloria and Art can make to a Roth IRA in 2020?

Scroll for answer...

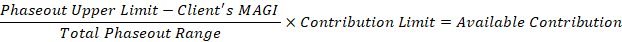

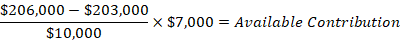

Correct answer: $2,100

Instructor insight:

Roth IRA phaseouts:

| Single | $124,000 - $139,000 |

| Married filing jointly | $196,000 - $206,000 |

| Married filing separately | $0 - $10,000 |

From the Provided Tax Tables.

CFP® Exam insight:

If the MAGI for a given client allows for a contribution to a Roth IRA and an above-the-line deduction for a Traditional IRA, the total combined annual contribution cannot exceed the limits of $6,000 (2020), and an over-50 catch-up of $1,000, or the total taxable compensation (if less than the contribution limits).

.png?width=440&name=bryant_logo_lockup_edc_color%20(002).png)