A COMPREHENSIVE & EFFICIENT CFP® SOLUTION

Boston Institute of Finance + Northwestern Mutual

- Northwestern Mutual advisors receive 20% off BIF's CFP® Education bundles.

- All BIF instructors are practicing CFP® Professionals that understand real-world client situations.

- BIF Education bundles include 21 months of access. Most students complete in 8-12 months or less.

Have any questions?

Submit the form below to have a Program Specialist reach out.

COMPLETE THE EDUCATION REQUIREMENT

BIF/Bryant CFP® Education

Our 7-course bundles include 21 months of program access. The Instructor-Led option puts you on pace to complete in 8 months. The BIF Review can be included now for more savings or added later.

NW advisors receive 20% off

Use coupon code NWM-20

NW advisors receive 20% off

Use coupon code NWM-20

PASS THE CFP® EXAM

The BIF Review.

How big is your marketing team?

Lorem ipsum dolor sit amet, consecteturor adipiscing elit. Tincidunt donec vulputate ipsum erat urna auctor. Eget phasellus ideirs. Lorem ipsum dolor sit amet, consecteturor adipiscing elit. Tincidunt donec vulputate ipsum erat urna auctor. Eget phasellus ideirs.

How big is your marketing team?

Lorem ipsum dolor sit amet, consecteturor adipiscing elit. Tincidunt donec vulputate ipsum erat urna auctor. Eget phasellus ideirs. Lorem ipsum dolor sit amet, consecteturor adipiscing elit. Tincidunt donec vulputate ipsum erat urna auctor. Eget phasellus ideirs.

How big is your marketing team?

Lorem ipsum dolor sit amet, consecteturor adipiscing elit. Tincidunt donec vulputate ipsum erat urna auctor. Eget phasellus ideirs. Lorem ipsum dolor sit amet, consecteturor adipiscing elit. Tincidunt donec vulputate ipsum erat urna auctor. Eget phasellus ideirs.

How big is your marketing team?

Lorem ipsum dolor sit amet, consecteturor adipiscing elit. Tincidunt donec vulputate ipsum erat urna auctor. Eget phasellus ideirs. Lorem ipsum dolor sit amet, consecteturor adipiscing elit. Tincidunt donec vulputate ipsum erat urna auctor. Eget phasellus ideirs.

How big is your marketing team?

Lorem ipsum dolor sit amet, consecteturor adipiscing elit. Tincidunt donec vulputate ipsum erat urna auctor. Eget phasellus ideirs. Lorem ipsum dolor sit amet, consecteturor adipiscing elit. Tincidunt donec vulputate ipsum erat urna auctor. Eget phasellus ideirs.

Self-study materials for experienced advisors.

- Exam Prep Materials (3 books & online access)

- Online Classroom Lectures. Released weekly in batches throughout the 8-week schedule. Our progressive approach maximizes long-term knowledge retention.

- Instructor-led Mini-Sessions held mid-day periodically throughout the 8-week schedule.

- 3 QBanks (Pre-Study Assessment, Exam Prep, & Financial Calculator)

Comprehensive, guided preparation experience to maximize chances of success on the CFP® Exam.

- Exam Prep Materials (3 books & online access)

- Online Classroom Lectures. Released weekly in batches throughout the 8-week schedule. Our progressive approach maximizes long-term knowledge retention.

- Instructor-led Mini-Sessions held mid-day periodically throughout the 8-week schedule.

- 3 QBanks (Pre-Study Assessment, Exam Prep, & Financial Calculator)

- Question Breakdown “JAM” Sessions. Held every Thursday for 8 weeks. Learn how to take the Exam w/ the BIF Crew.

- "Deep Dive" Sessions on Highly Testable Topics. Held every Tuesday for 8 weeks. Topics include Tax Deductions, Options/Hedging, Behavioral Biases, and more.

- BIF's Mock Exam (170 Exam-level questions)

- BIF's Formula Sheet Strategies

- BIF's Case Study Strategies

- Access to BIF's Online Student Community

- One Premium BIF Review retake

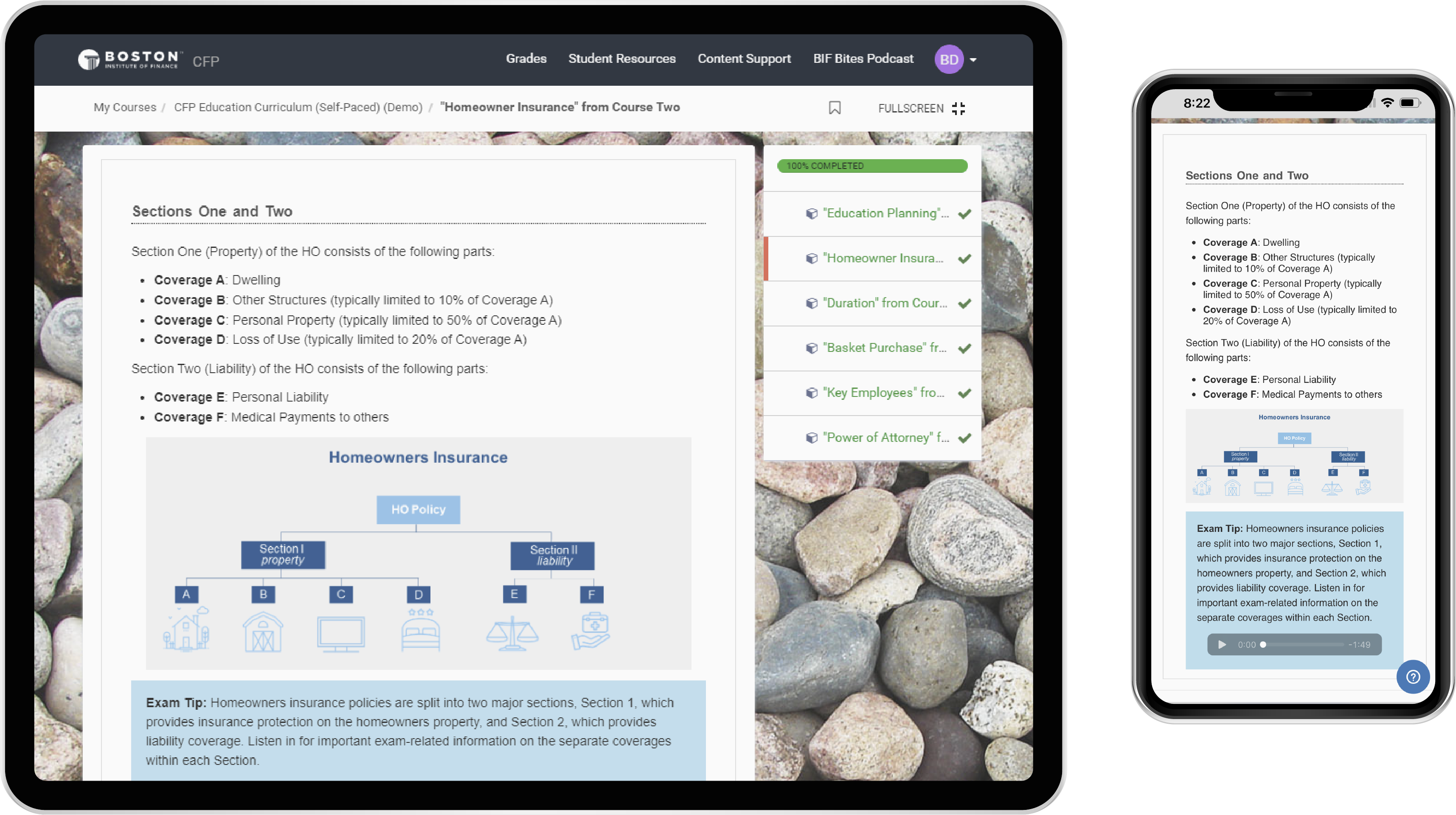

Our curriculum is mobile friendly. Study on-the-go!

Listen in the car. Watch on the train. Whatever works for you.

BIF has 2 goals.

Nothing more, nothing less.

Goal #1 is PASSING the Exam. Our materials are packed with helpful Exam Tips from start to finish. We intentionally keep the Exam front-of-mind, which results in progressive Exam Prep throughout the journey. This minimizes the need to cram late.

Exam Tip: Homeowners insurance policies are split into two major sections, Section 1, which provides insurance protection on the homeowners property, and Section 2, which provides liability coverage. Listen in for important exam-related information on the separate coverages within each Section.

Actual Exam Tip Box from BIF/Bryant CFP® Education Program.

Goal #2 is enabling students to enhance their practice while studying. The BIF Crew highlights key topics that may help clients in real-time. Many students successfully implement new knowledge well before they officially earn the CFP® marks.

Practioner Advice: Special rules for determining basis apply to the 'basket purchase' of real estate & land. Listen in for an explanation of how basis is established on a real estate 'basket purchase' and what this means to a building owner.

Actual Practitioner Advice Box from BIF/Bryant CFP® Education Program.

BIF breathes life into CFP® topics with multi-media content.

Info-graphics, audio clips, and videos make learning easier.

Here's an info-graphic example. The "text wall" is broken. Our students get to the point of understanding faster.

Grantor Retained Annuity Trust (GRAT): The grantor retains a right to payment of a fixed amount for a fixed number of years.

Grantor Retained Unitrust (GRUT): The grantor retains the right to payment of a fixed percentage of the value of the trust property (determined annually) for a number of years.

Actual content page from The BIF Review.

Here's a video example. We provide practical explanations only. Stuffy lectures are banned.

Education Funding Calculation Example:

Ricky Jones would like to plan for his daughter's college education. His daughter was born today and will attend a private university at age eighteen for four years. The cost of the university in today's dollars is $18,000 and is expected to increase at a rate of 6% annually. Inflation is expected to be at 3% annually. Ricky is expecting to earn an after-tax return of 9% on his investments. How much must Ricky save at the end of each year if he expects to make his last payment at the beginning of his daughter's first year of college?

- Step 1: Inflate the current cost of tuition by the tuition inflation rate for the number of years to go before college begins: $18,000 (PV); 18 (N); 6 (I); solve for FV: $51,378

- Step 2: Determine the total funding need for four years of college (present value of an annuity due): Begin mode on calculator; $51,378 (PMT); 4 (N); 2.83 (I) =(1.09/1.06)-1 x100; solve for PV: $197,183

- Step 3: Determine the end of year payment needed to save $197,183: End mode on calculator: $197,183 (FV); 18 (N); 9 (I); solve for PMT: $4,774

Actual content page from BIF/Bryant CFP® Education Program.