This is a guest blog written by the co-founder of Blueprint Investment Partners. For more great content please check out Blueprint's Insights page.

What incredible times we are living through right now. About six weeks ago here in the United States all seemed quiet and strong. Of course, there are always problems, but by comparison to today, things were positive. Boy, that seems like a long time ago.

Regardless of how this coronavirus pandemic plays out, the lesson we can already take from this is that... you just never know. No matter how good things seem and no matter how long the fun ride has lasted, it always comes to an end, and usually when we least expect it. The movie Cocktail, starring Tom Cruise, brings us Flanagan’s Law, “All things end badly or else they wouldn’t end.”

NEW PHRASES I SAY EVERY DAY FOR $1000, ALEX

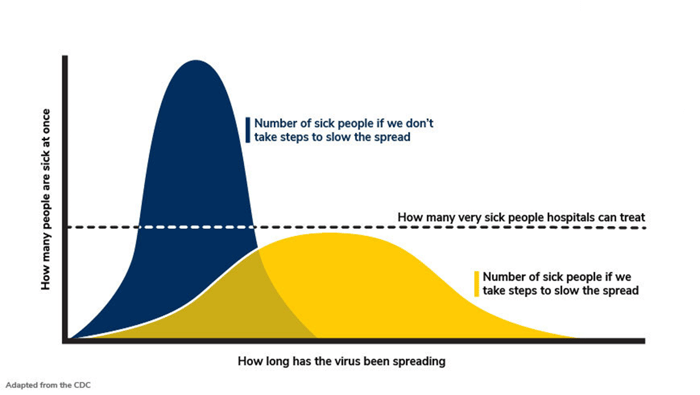

Flatten the curve - a phrase that once was uttered only by data scientists and perhaps those from the medical field has now become part of our everyday lexicon. This is the idea that to minimize the damage of a virus, a population must enact restrictions, either voluntarily or by government intervention, that reduce the spread and thereby limit the number of cases to a level where the medical system can address each case effectively. A critical mass exists which illustrates the point of maximum capacity for the system. Over time, the population builds resistance, develops vaccines, and increases its ability to handle future breakouts. The graph below illustrates this phenomenon.

Source: Michigan Medicine

THE INVESTOR CURVE

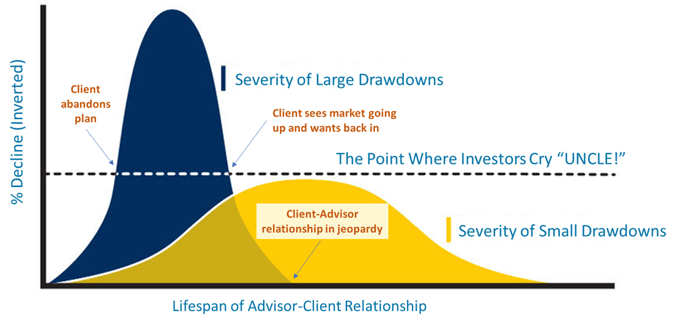

While managing client assets through the Financial Crisis earlier this century, the Blueprint team witnessed an eerily similar curve relating to investment returns and client behavior. We knew we would see the phenomenon again at some point, but as of January we did not think it would come so soon. It is now rearing its head again amidst this crisis.

This version of the curve relates to a drop in an investor’s account values and what happens when their investment and savings values reduce beyond the point at which they can emotionally maintain the investment plan developed prior to the crisis.

Once the drop becomes too severe, the investor will tend to abandon the plan and run to safety or look elsewhere for alternatives to ease the pain and anxiety of declining values. History has proven that at some point later they will rue the decision, but in the irrationality of the moment a biological ‘fight or flight’ response takes hold. De-risking the client’s portfolio can help, but leaves the investor or their advisor with the question of when it is safe to ‘re-risk’ it. The graph below illustrates this curve.

Source: Blueprint Investment Partners

FLATTENING THE INVESTOR CURVE

Similar to the concept of containing the spread of a virus, if an advisor can flatten the curve for an investor and stay below the point where they cry “Uncle!” then the advisor can prolong the relationship and ‘treat the patient’ enough to calm the anxiety and keep them on target for the long term. Our data, and that of many others, suggests that mitigating risk while maintaining proper exposure to the market is the key to successful long-term investing.

Further, flattening the curve is also highly beneficial for the advisor. Assuming they are a fee-based financial advisory firm, then flattening the curve benefits the business, dampening volatility in overall AUM. This is a perfectly symbiotic relationship where goals for the advisor and client are aligned.

EASIER SAID THAN DONE

So how does the advisor do this? Well, we have written about this many times before. The components of managing client behavior begin with core elements of investment planning such as suitability and investment horizon. Further, managing expectations around a client’s return goal based upon their financial plan is critical. Most importantly, advisors should employ strategies that reduce volatility and increase the client’s probability of achieving those goals.

With all strategies, diversification is a key tool. And managing cash and fixed income as a buffer to risk has been a long-utilized approach. But over the last decade bonds have not offered the diversification needed to reach return goals, and a higher allocation to equities has been required (See 60/40 Is Not a Strategy).

Without a robust investment strategy, advisors are stuck between a rock and a hard place.

MORE THAN SUITABILITY

This presents the opportunity for having a dynamic core portfolio, or at minimum, a reliable tactical satellite position to offset the risks of an otherwise passive portfolio. Employing a systematic strategy allows the advisor to avoid watering down suitability for favorable market periods while also being able to visibly de-risk the portfolio during periods of higher volatility. The goal is addressing the known, but unpredictable and asymmetric impact of volatility on client behavior.

No one can plan for an exogenous event like a global pandemic, but having a good strategy in place before the event will reduce the damage and allow for much faster recovery.

During extreme uncertainty advisors need to have a plan in advance, and to communicate it effectively. The plan needs to presuppose uncertainty and be able to not only respond to risk, but also to take advantage of oversold conditions and the ensuing opportunities. Advisors who have such a strategy have a tremendous advantage during times like this to expand their reach and grow their businesses – maybe not during the crisis, but soon after when things calm and clients search out those who protected capital in the crisis.

.png?width=440&name=bryant_logo_lockup_edc_color%20(002).png)